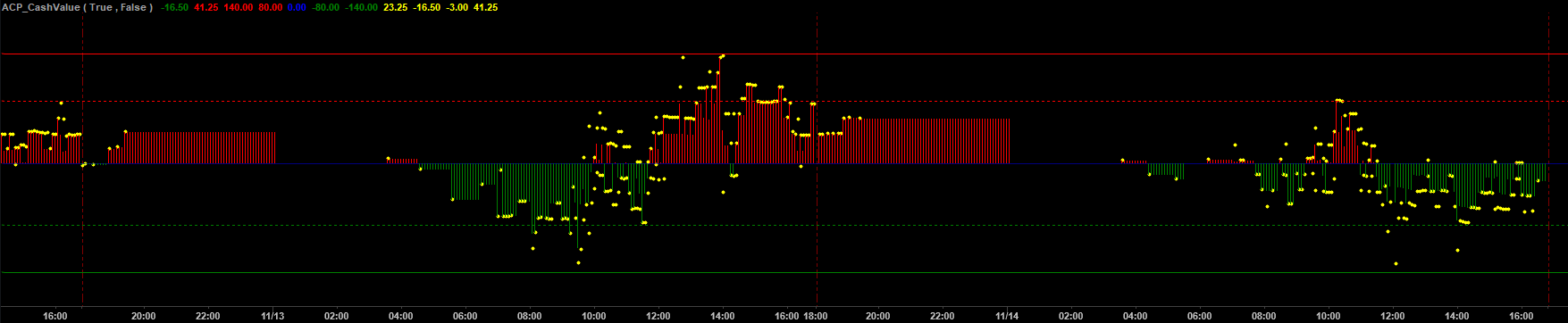

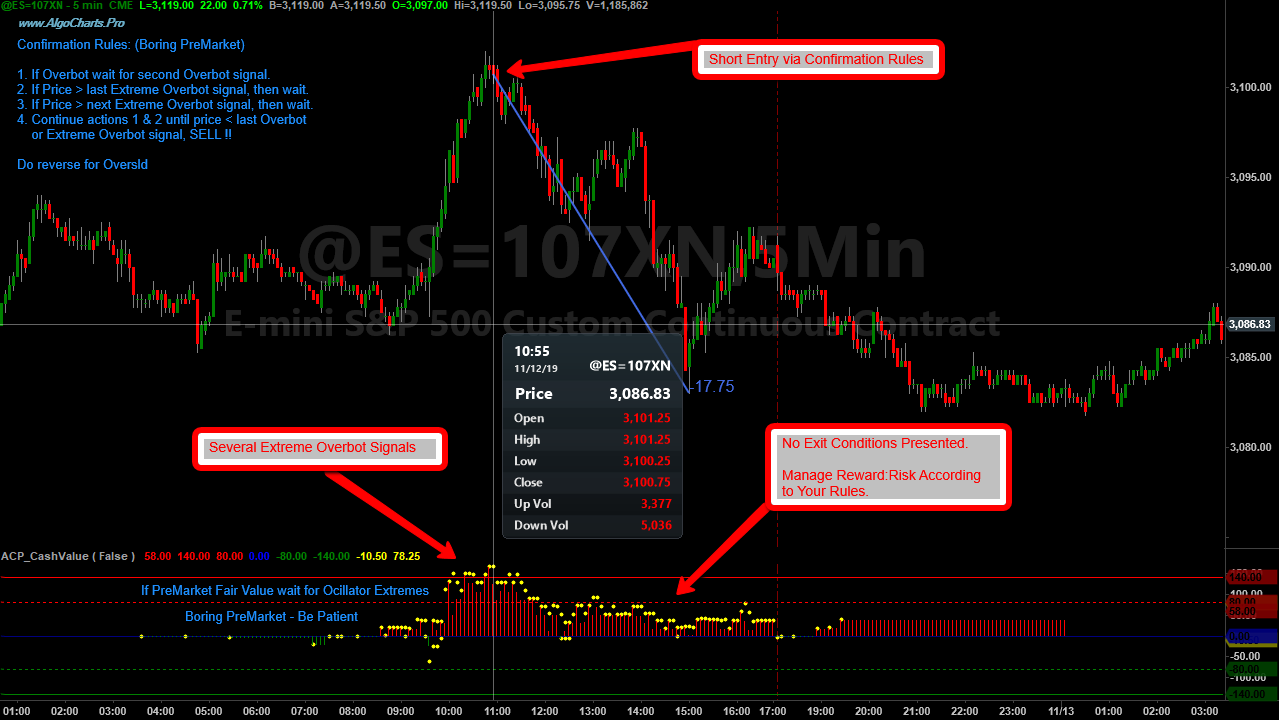

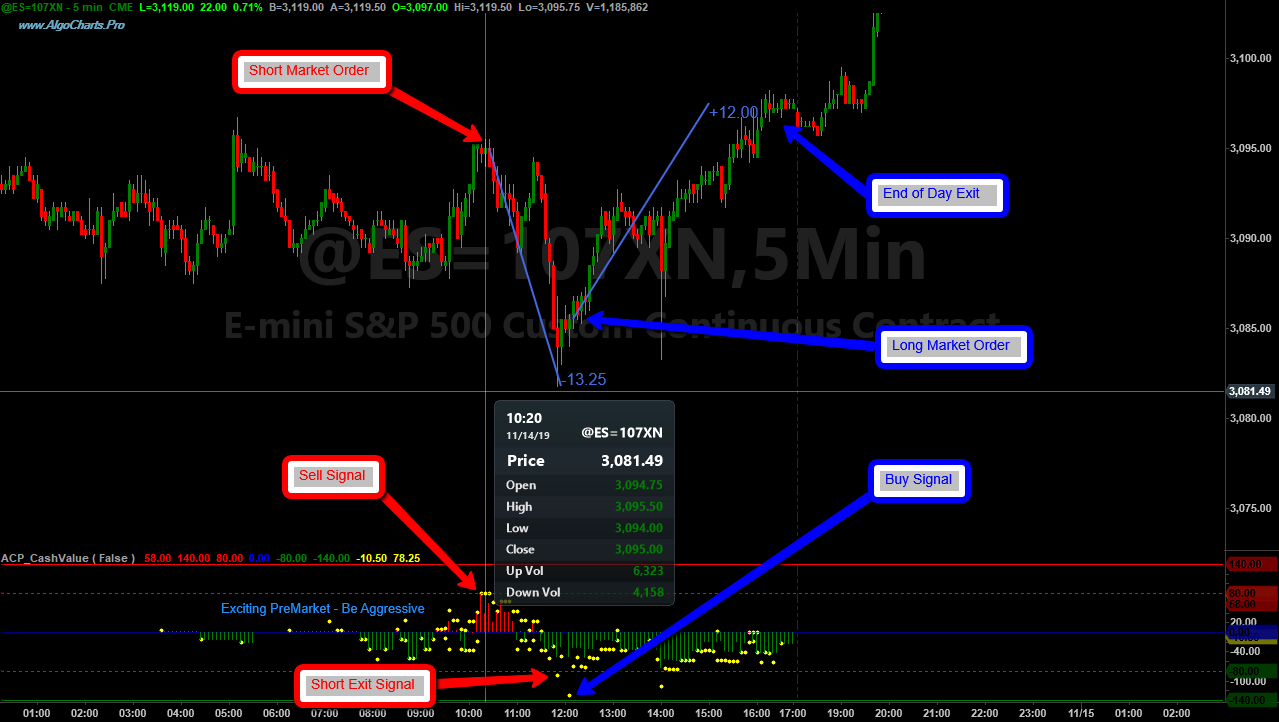

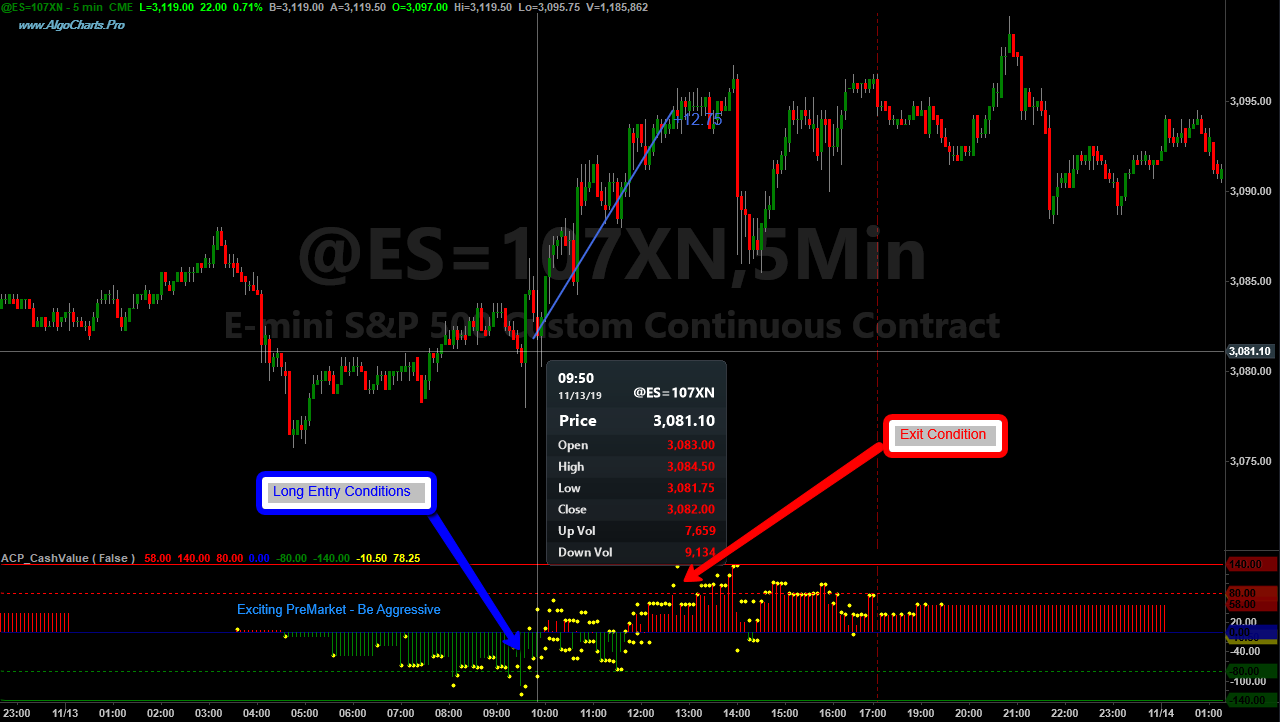

Real-Time Cash Value Oscillator has been designed using proprietary algorithms to capture the performance of the Dow 30 Stocks vs Dow Futures. If the Futures value exceeds the cash value, the market is overbought signaling selling opportunities. If the futures value is below the cash value, the market is oversold signaling buying opportunities. If cash and futures are equal, market is at fair value meaning the Trader should wait for better trading opportunities.

Using the Real-Time Cash Value Oscillator, we have developed a Discretional Day Trading Strategy that provides Real-Time Long, Short, and Exit signals. The Trader can use this strategy throughout the trading day to confidently enter and exit trades. The oscillator is an excellent confluence when used with Support & Resistance Zones.

Consequently, as with all Real-Time Market Data, historical data is not readily available rendering it impossible to back test. Included with the Oscillator is the ability to record historical data. If the Oscillator is turned off and then turned back on it will add the historical data to the chart allowing for back testing of historic performance. Historical Data is only recorded whilst the Oscillator is operating.

The Oscillator has been coded using advanced Object Orientated coding methodologies providing robust performance results predominantly leading to less CPU & Memory consumption and Memory leaks. You can be assured that all our coding efforts are tailored for CPU & Memory concerns from the onset.

Cash Value Oscillator Media

STANDARD

$79.991 Month License

- Unlimited Usage

- Unlimited Version Release

- Source Code NOT Included

- Ownership NOT Included

PREMIUM

$639.991 Year License

- Unlimited Usage

- Unlimited Version Release

- Source Code NOT Included

- Ownership NOT Included

ULTIMATE

$1,279.992 Year License

- Unlimited Usage

- Unlimited Version Release

- Source Code NOT Included

- Ownership NOT Included

Discounts are not available for this product.

DISCLAIMER

Algo Chart Pro is a software company. We are not in the business of providing financial or investment advice, nor are we registered with the proper authorities to do so. The product we provide (both the software and its associated documentation, examples, etc.) is for educational purposes only and should never be construed as providing trading or investment recommendations or advice. Any decisions you make using this product are made at your own risk and are yours and yours alone. Remember that trading is inherently risky, and traders may sustain losses greater than their investments regardless of which asset classes are traded. Before trading, carefully consider the risks involved in light of your financial condition and never trade money you can't afford to lose.

Required US Government Disclaimers: Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed here. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN INHERENT LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN ACTUALLY EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.